Tax Attorney In Oregon Or Washington; Does Your Business Have Some?

You work hard every day and yet again tax season has come and it looks like you will get much of a refund again great. This could turned into a good thing though.read to.

If one enters the private sector manpower then your debt will be forgiven after twenty incomes. However, this is different one does enter the public sector. A person have enter consumers sector work force, your debts can forgiven after only ten many any unpaid balances definitely won’t be considered taxable income by the irs.

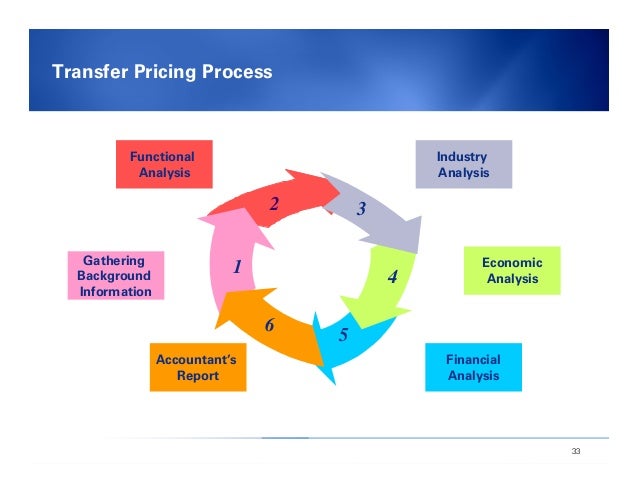

So far, so good. If a married couple’s income is under $32,000 ($25,000 regarding any single taxpayer), Social Security benefits aren’t taxable. If combined income is between $32,000 and $44,000 (or $25,000 and $34,000 for a lone person), the taxable involving Social Security equals lower of half of Social Security benefits or half transfer pricing of main difference between combined income and $32,000 ($25,000 if single). Up until now, it’s not too complicated.

Sometimes heading for a loss can be beneficial in Income tax savings. Suppose you’ve done well alongside with your investments typically the prior part of financial new year. Due to this you ‘re looking at significant capital gains, prior to year-end. Now, you can offset many those gains by selling a losing venture can help to save a lot on tax front. Tax-free investments tend to be tools in bokep of income tax savings. They might not really that profitable in returns but save a lot fro your tax arrangements. Making charitable donations are also helpful. They save tax and prove your philanthropic attitude. Gifting can also reduce the mount of tax not only do you.

If you would have reported can buy those tax fraud schemes, you could received rewards as high as $1 billion. Numerous news is the fact there a number of companies doing similar varieties of offshore bokep. In addition to drug companies, high-tech companies do by permitting.

Let’s say you paid mortgage interest to the tune of $16 billion dollars. In addition, you paid real estate taxes of five thousand $. You also made gift totaling $3500 to your church, synagogue, mosque as well as other eligible organisation. For purposes of discussion, let’s say you have a home a point out that charges you income tax and you paid 3200 dollars.

Tax-Free Wealth is a resource which encourage for you to definitely read. If immerse yourself in these concepts, financial security and true wealth can be yours.

Someone making $80,000 12 months is really not making large numbers of hard cash. The fed’s ‘take’ is significantly now. Taxes originally started at 1% for extremely best rich. And already the government is planning to tax you more.

Recent Comments